EXCEPTIONAL HIGH-GRADE GOLD ASSET IN ACCESSIBLE SOUTHCENTRAL ALASKA

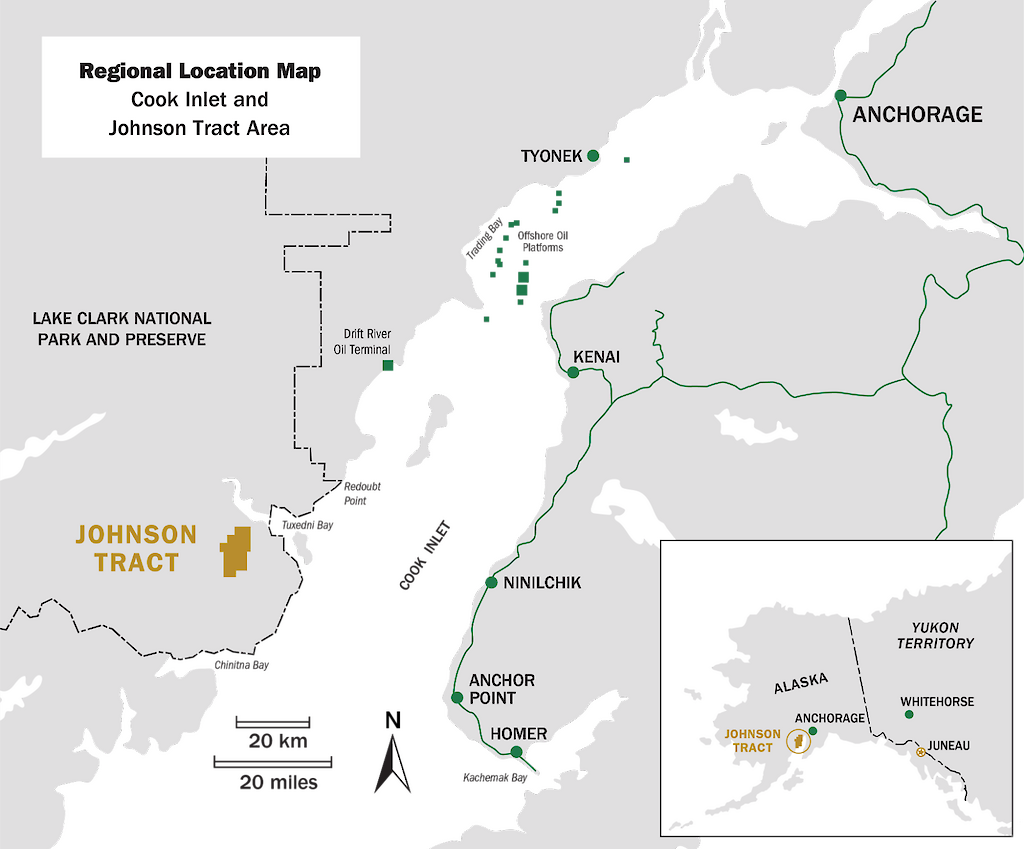

Johnson Tract is a polymetallic (gold, zinc, copper, silver, lead) project located near tidewater, 125 miles (200 kilometers) southwest of Anchorage, Alaska, USA. The 21,000-acre property includes HighGold’s flagship high-grade JT Deposit, the newly discovered Ellis Zone, and at least nine (9) other mineral prospects over a 12-kilometre strike length.

HighGold acquired the Project through a lease agreement with Cook Inlet Region, Inc. (“CIRI”), one of 12 land-based Alaska Native regional corporations created by the Alaska Native Claims Settlement Act of 1971. CIRI is owned by more than 9,100 shareholders who are primarily of Alaska Native descent.

Originally explored from 1982 to 1995, the Project was inactive for almost 25 years prior to acquisition by HighGold in 2019. The large land package is underexplored and has significant exploration potential. HighGold is focused on expanding the JT Deposit and Ellis Zone and generating new discoveries.

At the same time, HighGold is advancing elements that will facilitate eventual mining at the JT Deposit, including an expanded airstrip, an underground access ramp to expand and upgrade the resource, and a road to a barge landing at the coast. Baseline studies, permitting, and design work are underway.

With an existing high-grade resource at Johnson Tract that will only increase with further drilling, the Company is assessing opportunities for near term production. The JT project is conveniently located close to tidewater which presents a unique opportunity for directly shipping ore mined at JT by barge to an existing mill facility.

The JT Deposit hosts an Indicated Resource of 3.489 Mt grading 9.39 g/t gold equivalent (“AuEq”) comprised of 5.33 g/t Au, 6.0 g/t Ag, 0.56% Cu, 0.67% Pb and 5.21% Zn. The Inferred Resource of 0.706 Mt grading 4.76 g/t AuEq is comprised of 1.36 g/t Au, 9.1 g/t Ag, 0.59% Cu, 0.30% Pb, and 4.18% Zn.

Metallurgical test work results indicate excellent recoveries with a gold recovery of >97% and base metal recoveries ranging from 80-90% to separate copper, zinc, and lead concentrates. Deleterious elements generally occur in low concentrations.

Select JT Deposit drill intersections include:

- 108.6 m grading 10.4 g/t Au, 7.6% Zn, 0.7% Cu, 2.0% Pb and 8 g/t Ag (JT82-004 Original Discovery)

- 71.4 m grading 20.9 g/t Au, 9.8% Zn, 0.9% Cu, 1.6% Pb, and 9 g/t Ag (JT88-034)

- 137.7 m grading 11.3 g/t Au, 2.4% Zn, 0.5% Cu, 0.5% Pb, and 4 g/t Ag (JT93-067)

- 107.8 m grading 12.4 g/t Au, 7.1% Zn, 0.9% Cu, 1.6% Pb, and 9 g/t Ag (JT19-082)

- 75.1 m grading 10.0 g/t Au, 9.4% Zn, 0.6% Cu, 1.1% Pb, and 6 g/t Ag (JT19-090)

- 74.1 m grading 17.9 g/t Au, 7.3% Zn, 0.5% Cu, 1.3% Pb, and 7 g/t Ag (JT20-092)

- 56.6 m grading 19.3 g/t Au, 2.4% Zn, 0.5% Cu, 0.4% Pb, and 3.9 g/t Ag (JT21-125)

- 120.5 m grading 18.8 g/t Au, 3.9% Zn, 0.6% Cu, 0.9% Pb, and 6 g/t Ag (JT22-152)

The outcropping Ellis Zone was drill tested in 1983 by Anaconda Copper with two drillholes. The zone was not tested again until HighGold drilled 577.9 g/t Au and 2,023 g/t Ag over 6.40 m in hole DC21-010 in 2021. HighGold continues to grow the Ellis Zone with the objective of generating an initial resource estimate for the new discovery.

Select Ellis Zone drill intersections include:

- 6.4 m grading 577.0 g/t Au, 2023 g/t Ag, 2.15% Zn, 0.3% Cu, and 0.23% Pb (DC21-010)

- 42.8 m grading 3.4 g/t Au, 23.3 g/t Ag, 0.21% Cu, 0.83% Pb, 2.06% Zn (DC22-036)

- 35.2 m grading 4.2 g/t Au, 6.1 g/t Ag, 0.12% Cu, 1.4% Pb, 3.19% Zn (DC22-045)

- 14.8 m grading 10.14 g/t Au, 13.8 g/t Ag, 0.28% Cu, 0.46% Pb, 5.97% Zn (DC22-046)

Snapshot

| Location | Southcentral Alaska, USA |

| Ownership | Highgold Mining Lease agreement for 100% subject to certain back-in rights by CIRI. |

| Status | Active Exploration |

| Deposit Type | Epithermal with submarine volcanogenic attributes |

| Property Size | 8,475 hectares (20,942 acres) |

| Host Rock | Bimodal Volcaniclastic |

| Age | Jurassic |

| Main Economic Elements | Gold, Zinc, and Copper, with Lead and Silver credits |

| Approximate Geometry | JT Deposit is a thick, steeply dipping body (20m to 50m average true thickness) |

| Mineral Resource | 1,053,000 ounces AuEq @ 9.39 g/t AuEq Indicated 108,000 ounces AuEq @ 4.76 g/t AuEq Inferred |

| Potential Mine Method | Underground |

Location Map

Project History

The Johnson Tract drill discovery was made by Anaconda Minerals in 1982.

Past work (1982-1995) included eighty-eight (88) drill holes for a total of 26,840 meters, and major engineering and mining related studies by Westmin Resources Ltd. that evaluated direct shipping ore to their Premier mill in Stewart, British Columbia.

Past work prioritized engineering at the expense of exploration, resulting in significant untested exploration potential.

The Project reverted to CIRI in the late 1990s and saw no work until HighGold acquired the project in 2019.

Agreement with CIRI

HighGold’s lease agreement is with Cook Inlet Region, Inc. (“CIRI”), one of 12 land-based Alaska Native Regional Corporations created by the Alaska Native Claims Act (ANCSA) of 1971. CIRI selected the Johnson Tract lands through ANCSA and, in addition to mineral and surface rights, CIRI was also granted port and transportation easement across adjoining parkland to support the extraction of minerals.

The lease agreement between HighGold and CIRI has an “Initial Term” of 10-years, followed by a 5-year “Development Term” to achieve a mine construction decision, and then a “Production Term” that will continue for so long as operations and commercial production are maintained. Minimum exploration expenditure and annual lease payments are required to maintain the lease until production. CIRI maintains certain NSR royalty rights and a back-in right for up to a 25% participating interest.